Meredith doesn’t like talking finances, but she’s going to for your benefit! This week is all about the frustration of not being as prepared as she’d like to be, the privileged position she’s in because she’s raising this baby with her mother, the cost of each medication prescribed for the upcoming egg retrieval, and a quick rant about the state of the entertainment industry (her given profession).

Transcript

In college, my gay best friend and I joked that if we hadn’t found love by 40, we’d have a baby with each other 20 years later. I’m pulling the ripcord. I’m deciding on solo motherhood, to choosing IVF. I’m Meredith and this is THE BACKUP Plan.

Hey everybody, I’m going to talk about something today that I don’t like talking about Finances. I love money. I don’t love finances right now.

I’m having a tough time with finances right now. If I’m totally honest, a big part about this whole journey is money, because it’s going to cost money. I can’t just hop in bed with any Tom, dick or Harry–I could. But the way that I want to have this baby requires me to spend money. Money has to be spent on testing. Money has to be spent on the cryopreservation. Money has to be spent on the medication that I’m going to be taking. We’re going to get into that later in the episode, but it’s just…a lot of money is being spent and I hit a breaking point this week.

I can share all my excitement and all my happiness about why I’m doing this, but if I don’t talk about the frustrating aspect of it as well, that’s just not honest. This is about being honest. We’re being honest here. We’re telling the story worts and all.

I hit a personal finance boundary. This week I have tapped out my credit card. Guys, it’s happened.

I had gotten really, really good with my personal finances a couple of years ago, before COVID. I was making a lot of money. I was working at Netflix, I was traveling the world, I was putting money away into savings, I was paying off all the bills that I had, I bought a condo. Everything was great. Everything was perfect.

Then COVID happened and I lost that job. I was offered another job at Lucasfilm, which–I’m a huge Star Wars fan. It was like, a dream come true. It did have a serious pay decrease, but for the opportunity to put that on my resume, the people I was going to meet in those rooms and on those sets? There’s no question about it. I was going to work for Grogu.

Baby Yoda was my boss.

I’m not sorry about it, but it did put me a few steps back financially. Then I got into the job I’m at now, where I’m making less than what I was making at Netflix, more than I was making at Lucasfilm, but I haven’t caught up. I

t just broke me this week. It’s not fun to admit, and I would much rather be in a more stable place. I don’t want to have a kid while having debt and then also student loan debt. I still have a crazy amount of student loan debt. I hate it, but the clock is ticking and it’s got to happen.

I’ve talked to my mom about this at length, and I would say that a lot of the money fears that I have…it’s definitely generational trauma. And my mom definitely helps to perpetuate some of it. But she and I are both are trying to get rid of that so that whatever little baby comes out of me does not suffer the same way that we have.

I remember being a kid and she used to like on the day she did the bills, it was like do not enter the dining room because that’s where everything was spread out, and like you just did not want to be around her as she was doing it because she was just snippy and it’s like the anxiety that she had was so palpable. Thankfully, now bills are just easier. It’s not about sitting down and writing out all the checks, making sure they get sent at the right time. It’s a lot easier with online bill paying stuff. But she’s still a little teeth gritty when it comes to bill time and finances and that sort of a thing.

And I’ll say this, too, like, we’re fine. Like, as a family we’ve always been fine. It’s just, you know, my parents’ parents were raised during the depression and that stuff just kind of lives in your bones for a while. So we’re moving past that and I called my mom this week and, you know, just had this emotional explosion about how much I don’t want to keep going to her for things and how much I don’t want to rely on her. I really want to be able to take care of her and this baby. I want to be the caretaker and be the bread winner, and we’re working towards it. There are some other plans in the works, but at the moment it’s not what it is.

She said something to me this week that was like super, super helpful. She said to me, ‘We’re partners.’

‘We’re partners right now and don’t worry, I’ve got you, things are going to be fine, so it’s great.’

I just think it’s really important that I acknowledge my privilege in all of this, because not everybody gets the help that I’m able to get in this, you know. And I’m living on the edge,,,but I’m still sitting here in my little beige sweater, with my little beige couch and my little beige house.

…It’s not too beige. There’s color, don’t worry. I’m not one of those, like, clean aesthetic gals.

But anyway, the other part of my privilege that I know I need to acknowledge here is that I work at a job that gives me a fertility benefit. They give a $15,000 lifetime benefit. So that’s it, I get to use that and I’m done and it’s all I’m going. IVF is going to cost a little bit over that for the procedure, not the medications. So the medications on top of all that are going to be another $6,000ish. (We’ll get into the breakdown of that in just a second.) There’s also the embryo testing that I’m going to be doing. That’s another additional $6,000, I think. So in total, what my out of pocket is going to be is roughly about $13,000 for this process, with that $15,000 that I’m getting from my insurance company.

Let’s talk about this fertility benefit, because they don’t make it easy.

So I’m going on to the website. I knew that I got it, right, like, when they were going over the benefits package and how it was changing– I think last year –you know, we got all these emails that said, ‘Hey, you’re getting this benefit,’ and I was like, oh cool, that’s great, because I know what’s coming.

I’ve gone on to the website since then to read up on, like what it covers or how to redeem it or whatever. There’s nothing on the website, guys. There’s nothing, like, it’s just totally blank. There’s no mention of it. You have to search for maternity benefits and even then it says, ‘Call this phone number and talk to a representative,’ but of course, you’re going to have to go through a phone tree and you’re going to have to go through a robot and, like, dial one, press zero, say your social security number. You know it’s this thing, it’s not just easy to talk to somebody, so that’s annoying.

But what was really cool when I started KindBody is they had an insurance coordinator who went over. They said we’ve gone to your insurance company. These are all the benefits you get. So I know I have this $15,000 amount, right, and because I am in a sticky situation now, I want to use that money as quickly as I can, right, I would like to use it towards the medication. I call it Shraff’s Pharmacy, who is the one that works with KindBody and has the package of the drugs that I will be using.

So I called them up and they said we suggest saving that allowance that you get for the procedure and self paying for the medication right now. I said, okay, what’s the cost for self pay? They said about $6,000. I was like cool, cool, cool. All right, how do I use the benefit? They said, well, you have to go to another pharmacy. So in order to use that $15,000 allowance, I have to go to a pharmacy of my insurance is choosing. For reference, I’m using Highmark Blue Cross Blue Shield, which is, like some Pennsylvanian, some division of Blue Cross Blue Shield, because that’s where my corporate headquarters are located. So they said if you want to use this benefit, you have to go to Freedom Pharmacy, which I don’t like the sound of that. It’s a little too mega for me. But I said, fine, fine, fine, okay, great. They said, but just so you know, it’s going to be more expensive if you go there. Of course it’s going to be more expensive if I go there.

Great, how much more expensive. They said, well, you’ll tap out your full allowance, okay. So it’s just jumped from $6,000 to $15,000. But I said to myself you know what, they may just be saying that maybe this Freedom Pharmacy, maybe there is a. It’s a different story when you call them up, right? So I called them up yesterday and this is in addition to calling my credit card company to deal with the other issues. So it was just like there’s a reason why I was as tired as I was last night and why I had to sleep in this morning. I called Freedom Pharmacy and I said, hey, I’ve got the list of all the medications I get. I have not transferred my prescription to you yet, because I just wanted to call and see what my options were and I read off all the different drugs that I’ll be using which for your benefit. Let’s go over that now, shall we? There are five different drugs that I’m going to be taking and I’m going to read them right off my computer to you because they sound like aliens Follistim, luprolide, menopur, so Mactan this one’s my favorite.

It sounds, sounds like a character from Guardians of the Galaxy Ganylax, organon. Ganylax, organon. Right Like Lord Organon. First name Ganrelix. Okay. So follow-stim is a human follicle-stimulating hormone. Luprolite is hormone suppression, menapure stimulates follicles to release eggs and Zomactin is a growth hormone. And Ganrelix Organon, my favorite one, prevents premature luteinizing, hormone surges or ovulation. He’s doing the most work, mr Organon.

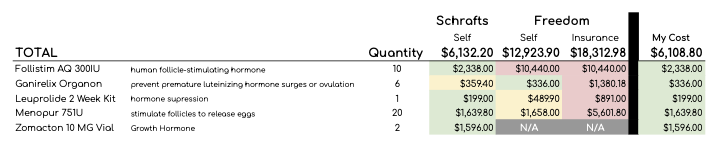

Now, if I go to shrafts, this is the cost of each of these drugs. Follow-stim is going to be $2,300. I’m just rounding off for your benefit here. Ganrelix Organon is going to be $360. Luprolite is $200. Menapure is around $1,600. And Zomactin is a little over. It’s almost $1,600 as well.

So I call freedom and they say well, you can self-pay or you can use your insurance. And I was like give it to me both. Let’s see what we got. Follow-stim if I pay for it by myself, it’s the same cost as if I go through insurance. It’s $10,440. Ganrelix Organon it’s actually cheaper there if I self-pay.

So I may be transferring this one prescription over to Freedom Pharmacy because it’s $336 there. But if it went through insurance it would be $1,300, almost $1,400. Luprolite is $489 if I pay for it myself, almost $900 if I go through insurance. Menapure is about $1650 if I pay for it myself and is $5,600 if I go through insurance. They don’t have Zomactin and apparently that’s not part of the normal plan. When I looked it up, it seems like maybe women who are a little bit on the pediatric side it’s a little bit it’s for my old ass overrace. So Insumation Shrafs is $6,132.20. If I go through Freedom Pharmacy, if I paid for it myself, it would be $12,923.90. And if I went through insurance, it would be $18,312.98.

Switching Lord Organ on over to Freedom Pharmacy, though, is going to save me a little bit, so my total out-of-pocket cost for this is going to be $6,108.80. That was a lot of work yesterday Going over all of that and seeing what my best options were, but, honest to God, I’m glad I did, because otherwise I would have been later down the line. I would have been like, oh shit, what if I transferred over here, transferred over there? It’s going to make more sense for me to pay for it this way. It is the cheapest way to go about it. I suppose I can look around and see if there are other pharmacies to send this to.

I don’t know. Guys, it’s a lot of work and it’s a lot of work to do alone. Not that I’m complaining, because I’ve chosen this, and also I know a lot of men who wouldn’t do this work, but I know a lot of men who would do this work because they like spreadsheets as much as me. So that’s kind of the general thrust of what I wanted to talk about this week was the finances. Like I said, I wish I was in a better place financially before going into this. I am considering a lot of different options to change the way I make money. I’m doing a lot of consideration about how it is that I do want to provide for this little family that I’m starting, and I’ve worked in film and TV for about a dozen years now and it’s a really frustrating business to be in right now.

The writer strike and actor strike really took a lot out of everybody last year and the industry just hasn’t recovered yet. There is the threat of another strike coming up. There’s a group called IOTC that they’re the production folks and their deal is coming up on the table and, from what I’ve heard, a lot of production just hasn’t started because studios don’t want to get things going and then have everything stop because there’s a strike again. It’s just been difficult and I’ve been questioning if I want to stay in this.

I worked on Star Wars. That was the goal. I wanted to be more creatively involved there, but just being on set and working with the folks who make the aliens and who direct the episodes and giving Mando hugs in the hallway, it’s pretty good. My name is in the scroll, so I’ve seen my name in that font. I’m like I don’t know how it’s at the end, but every time I try to stop working in the entertainment industry, you pull me back. In Case in point, I was like maybe I’m done here, and then somebody came up to me with an opportunity that could be a side hustle, could be a full-time job. I’m open, I’m receiving it all. It’s a new moon in Pisces. It’s a portal to different timelines, so I’m just trying to hop on one that’s lucrative and abundant for me and my little family, because I want to be able to show this baby the world. I want to be able to take care of my mom in her golden years. I want her to have the best experience that she could possibly have as a Nana on the West Coast. So, yeah, I just feel like this pregnancy is going to be, god willing, a portal.

There was the Oscars were this weekend and Emma Stone when she was accepting her award, which, like, oh God, I just love Emma Stone she is. There’s a picture for eating a chicken pot pie at the PGA Awards. I’m going to put it here because that’s that’s me. If you’re watching on YouTube you can see that’s a face I would make Eating a pot pie at an awards ceremony. I adore her and in her acceptance speech she thanked her daughter and said that her and her husband’s life became technicolor once her daughter came into the picture.

And that is how I feel in my gut and in my heart, that this like experience will be. I just got to get there and there’s only so much I can do to control it. And I’m really trying to temper myself with, like, not having expectations but getting excited but enjoying the process but not relying upon it, and it’s very difficult to do. It’s hard. You know, I started my period this week. I let my doctor know, so when I ovulate I’ll come in and they’ll do a little checkity check and then when I start my period next month is when I start injecting. It seems, once I get all of these drugs ordered from the various places, when Lord General X, organ on, descends upon my life, beams me up. Scotty, that’s a different property I know. Anyway, that is where we’re at in the middle of March, with St Patrick’s Day coming upon us shortly. I’m a little nervous. I’m missing the window to have a Capricorn baby, but we’ll just have to learn to love an Aquarius or Pisces. It’s going to be difficult.

Thanks for listening everybody. I know this is a little bit shorter than usual, but it’s a really pertinent, pertinent topic. We’ll get through it. I just keep telling my mom like we’re getting there, we’re getting there, we’re getting there. I have no question in my mind. There’s not a little bit of me that doesn’t think that things are going to be turning around in the next couple of weeks, slash months. I’m excited about it, but nervous about all the work that has to be done. That’s life, though. Right, I’m a shark. If I stop swimming I’ll die. Just keep swimming.

Anyway, hope you’re having a great week and be sure to follow on social. Please review on iTunes. That’s helpful and it makes me feel warm fuzzies on the inside. Be on the lookout. I had a photo shoot and I’m going to start incorporating that in. We’re going to have a new podcast cover. I’m going to put my face on this more. Shout out to Dana Gaydon of Modern Joy Studio. She did a really fantastic job. If you’re in Southern California, highly recommended. Other than that, I hope you guys have a great week and love you.

The backup plan is created, produced and hosted by me, meredith Cape. Julian Hagens is my co-producer. You can find us on social media at backupplanpod. The best place to get updates is to sign up for our newsletter at backupplanpodcom, where we also post all episodes, show notes and transcripts. Thank you for listening.